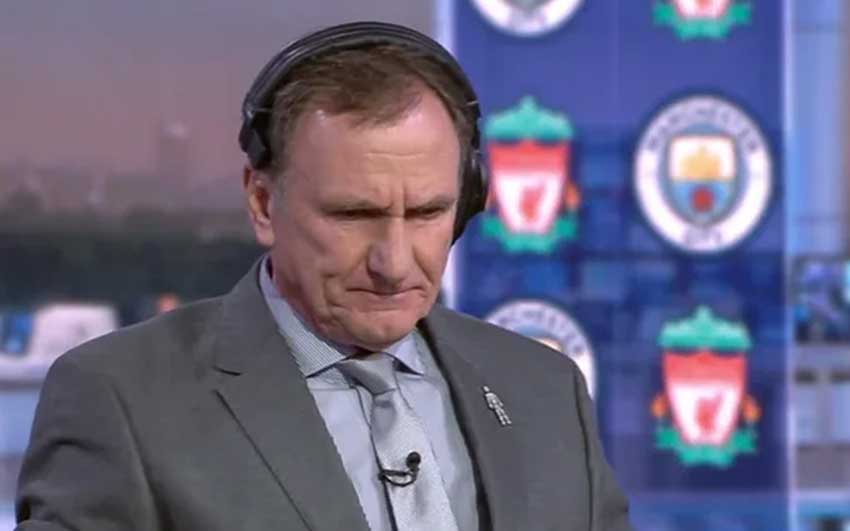

Former Liverpool footballer and Sky Sports pundit Phil Thompson has lost his IR35 appeal at the Upper Tier Tribunal, leaving him with a tax bill of nearly £300,000 after being deemed a ‘disguised employee’ of Sky Sports.

Thompson, who provided punditry on Soccer Saturday and other Sky Sports programmes between 2014 and 2018, was ruled to be inside IR35 by HMRC, meaning he owed £294,306 in tax.

The former footballer originally lost his case at the First Tier Tribunal (FTT) in 2023, with the decision hinging on Sky Sports’ control over his engagement—an indicator of employment rather than self-employment. Thompson appealed the ruling on four legal grounds, including the interpretation of his contract and the level of control Sky exerted. However, the Upper Tier Tribunal rejected each argument, stating there was “no material error of law in the FTT’s decision.”

The ruling highlights the increasing scrutiny of freelancers and contractors by HMRC, particularly those in high-profile media roles. Qdos CEO, Seb Maley, described the case as a familiar scenario, warning that “HMRC pursues a high-profile freelance presenter who has fallen into the trap of working in a way that reflects disguised employment. The result is a staggering tax bill.”

Maley emphasised the importance of reviewing contracts before and during engagements to avoid falling foul of IR35 rules. He added: “The bigger picture is that HMRC sees IR35 compliance as a priority. It was only last month that it emerged that the controversial off-payroll working rules generated an additional £4.2bn in tax since their introduction to the private sector—something that could well give HMRC the appetite to increase its compliance activity.”

Thompson’s case serves as a stark warning for freelancers and businesses alike. With HMRC ramping up its focus on IR35 enforcement, thorough contract reviews and clear working practices are essential to mitigating tax risks.