Recruiting top talent in real estate can be challenging. For brokerages, staying ahead means placing a consistent focus on recruiting high-potential, high-performing agents. However, in recent times, competition for productive agents has increased, leaving brokerages in a position to either evolve with the changing trends or risk significant losses to their business.

Emerging technologies are now making it possible for brokerages of all sizes to compete at higher levels. Decision science and data science together provide a powerful framework for brokerages to make more strategic, data-backed decisions in agent recruitment and retention. While data science focuses on collecting, analyzing, and interpreting large amounts of data, decision science leverages these insights to guide better choices, aligning them with business goals.

In a brokerage context, data science can gather and process key information on agent performance, transaction patterns, market conditions and agent satisfaction. Once these insights are uncovered, decision science applies methodologies to prioritize this information and create actionable strategies. It considers questions like: When and how should you reach out to agents most likely to switch?

Combining these strategies, a brokerage can develop a recruitment plan that is not only timely but also precisely targeted to attract high-potential agents.

When are agents most mobile?

Timing is critical. Brokerages should aim to understand when agents are more likely to make a switch. We analyzed data across the nation and found that agents often consider moving during slower market periods or at the start of a new year when they’re setting goals and evaluating if their current brokerage aligns with those goals.

Data from 1994 to 2024 reveals a clear seasonal trend: agent movement between brokerages closely follows national transaction patterns in the real estate market. However, between January and May, the number of agents changing offices surpasses the national transaction trend line, suggesting that more agents make moves during this period. Despite relatively lower transactional activity, this may indicate that agents are strategically positioning themselves ahead of the busy summer months to take advantage of better opportunities or market conditions.

Data from 1994 to 2024 reveals a clear seasonal trend: agent movement between brokerages closely follows national transaction patterns in the real estate market. However, between January and May, the number of agents changing offices surpasses the national transaction trend line, suggesting that more agents make moves during this period. Despite relatively lower transactional activity, this may indicate that agents are strategically positioning themselves ahead of the busy summer months to take advantage of better opportunities or market conditions.

After June, agent movement and national transactions align more closely, peaking in the summer before gradually declining toward December, mirroring the typical market slowdown. Essentially, if agents are identified as recording production at a new firm in spring and early summer, their decision to move likely occurred in the late winter months.

Key indicators of pending agent movement:

- A drop in active listings or a zeroed-out listing inventory

- Large changes to annual production; both positive and negative

- Special attention should be paid to agents with changes to typical behavior patterns such as disengagement in company training and events.

What ‘types’ of agents are most mobile?

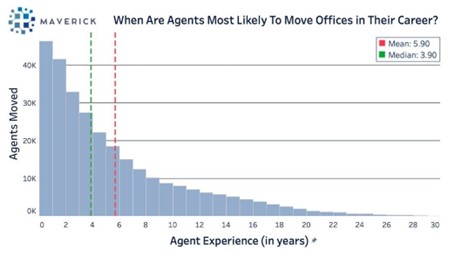

Not all agents are equally likely to move. Decision science helps categorize agents into profiles that indicate mobility. By examining data on agent tenure, earnings, satisfaction levels, and career goals, brokerages can identify which types of agents might be open to offers. We analyzed an agent’s ‘years in business’ to determine when an agent may be most mobile in their career. The data spanning 1994 to 2024 shows that most agents are moving between brokerages have fewer years of experience with movement declining as experience increases. The mean experience of agents who moved is 5.90 years while the median is 3.90 indicating a right-skewed distribution for less experienced agents make up the bulk of movements this gap between the mean and the median highlights that while newer agents dominate the moves there is still a notable number of experienced agents transitioning this suggests that newer agents are more likely to switch brokerages possibly for career development and better opportunities while more experienced agents move less often but may do so for more strategic or leadership-driven reasons.

We analyzed an agent’s ‘years in business’ to determine when an agent may be most mobile in their career. The data spanning 1994 to 2024 shows that most agents are moving between brokerages have fewer years of experience with movement declining as experience increases. The mean experience of agents who moved is 5.90 years while the median is 3.90 indicating a right-skewed distribution for less experienced agents make up the bulk of movements this gap between the mean and the median highlights that while newer agents dominate the moves there is still a notable number of experienced agents transitioning this suggests that newer agents are more likely to switch brokerages possibly for career development and better opportunities while more experienced agents move less often but may do so for more strategic or leadership-driven reasons.

Agent ‘types’ to watch:

- Up-and-comers: Identify newer agents—those with less than three years of experience—who show a positive year-over-year increase in their annual production. They may be ready to elevate their careers, and brokerages that effectively communicate how they can support this growth will capture their interest.

- Veteran agents with stalled careers: These seasoned agents, with over three years of experience, may be experiencing a decline in annual production, indicating they’ve hit a roadblock. They might need assistance adapting to emerging technologies that are impacting their business. Find ways to provide value and support to help reignite their careers.

- Top performers who have hit a ceiling: These high-performing agents consistently deliver strong results year after year, but their growth has stagnated. While they aren’t seeing declines, they aren’t making significant gains either. They may benefit from enhanced support services from the brokerage to help them reach new heights.

What economic & market conditions affect agent movement?

When market conditions tighten, agents may seek more robust support from brokerages that offer better leads, resources, or financial stability. Decision science can analyze these macroeconomic conditions to understand how economic cycles influence agent mobility.

Economic & market indicators to track:

- Interest rates: Higher rates tend to slow transactions, making agents feel insecure about changing brokerages. With economists predicting lowered interest rates in 2025, agents may become more mobile. Now is a good time to begin conversations with agents who have largely taken a ‘wait and see’ approach in 2024.

- Housing market forecasts: Downturns make agent support more crucial.

- NAR settlement: For several months following the 2024 NAR settlement, many agents hesitated to make moves due to uncertainty about how the changes would impact their careers and the industry as a whole. This apprehension kept agent mobility relatively stagnant as professionals grappled with the unknown. However, now that the dust has settled and the initial shock has worn off, agents are beginning to reassess their positions and explore new opportunities. As they gain clarity on the new market landscape and how brokerages are adapting, we can expect to see an uptick in agent movement as they seek firms that align with their evolving needs and career aspirations.

What seasonal conditions affect agent movement?

Typically, spring and summer bring high transaction volumes, while fall and winter slow down. This lull often prompts agents to reflect on their brokerage’s alignment with their long-term goals.

Key seasons to leverage:

- Holiday months (Nov.-Dec.): With most agents making moves in the late winter, the holiday season presents an excellent opportunity for brokerages to refine their systems and processes. This period is ideal for making strategic software investments to prepare for heightened recruitment initiatives in the new year.

- New year months (Jan.-Feb.): As agents emerge from the holiday lull, they often feel reenergized and ready to make changes. This key period is when agents are likely to consider switching firms to kick off the year on a positive note. Brokerages should be fully engaged in recruitment efforts during this time, seizing the momentum of the new year.

What tools help the most?

The right tools can be the difference between a well-considered recruitment strategy and a missed opportunity. By using tools like CRM systems with data analytics, brokerages can predict when agents are open to moving and personalize recruitment outreach.

Recommended tools:

- Customer Relationship Management (CRM) tool: A robust CRM can streamline the agent recruitment process by offering features such as role and permission assignments, lead scoring and tracking, recruitment funnels, easy database segmentation, and comprehensive sales reporting and dashboards.

- Agent analytics: Effective recruitment programs should be grounded in solid agent data. Good analytics provide valuable insights into opportunities and challenges within the recruitment landscape.

- Scheduling and Engagement Tools: Utilize scheduling software to simplify meeting setups with prospects, facilitating efficient relationship-building.

What brokers should be doing right now

Understanding agent mobility through data empowers brokers to attract top talent. Here’s how to apply these principles today:

- Analyze your existing data: Use your CRM to identify trends in agent tenure, performance, and satisfaction to spot mobility indicators.

- Build agent personas: Segment agents by factors such as years of experience, transaction volume, and career goals to tailor outreach.

- Optimize timing and outreach: Target recruitment during slower periods, when agents have more time for career reflection.

- Invest in tools: Enhance decision-making with CRM, data analytics, and scheduling tools, allowing you to manage recruitment like a well-oiled machine.

By adopting a data-driven, decision-science approach, brokerage leaders can gain insights into why agents move and effectively engage them with timely, relevant offers. The data we’ve analyzed indicates that now is the ideal time to refine your systems, processes, and tools in preparation for accelerated recruitment after the holidays. This proactive strategy represents a long-term investment in your recruitment efforts, positioning your brokerage for smarter, sustainable growth.

The analysis by Maverick Systems utilized data from five MLSs: BridgeMLS, MLSPIN, RMLS, Stellar, and SmartMLS. Agent movement was tracked by identifying the total number of unique offices each agent had transactions with and the date of their first transaction in each office. Offices without transactions were excluded. This approach enabled the assessment of agent movement patterns between offices, with the first transaction date indicating seasonality and the agent’s overall experience determined by their earliest transaction.

Diana Zaya is the founder and president of Maverick Systems, a data analytics and consulting firm dedicated to equipping brokerages with in-depth agent and brokerage analytics, astute data analysis, and inventive strategies to produce better agent recruitment and retention outcomes. To learn more, visit https://www.mavericksystems.com/.